Contents

If you regularly shop at Lowe’s, you might want to consider getting a Lowe’s credit card. With this card, you can save money on purchases, get special financing options, and earn rewards. Here you will find how to apply for a lowes credit card and manage it online. By learning so, you can also learn about lowes credit card benefits.

How to Apply for Lowes Credit Card

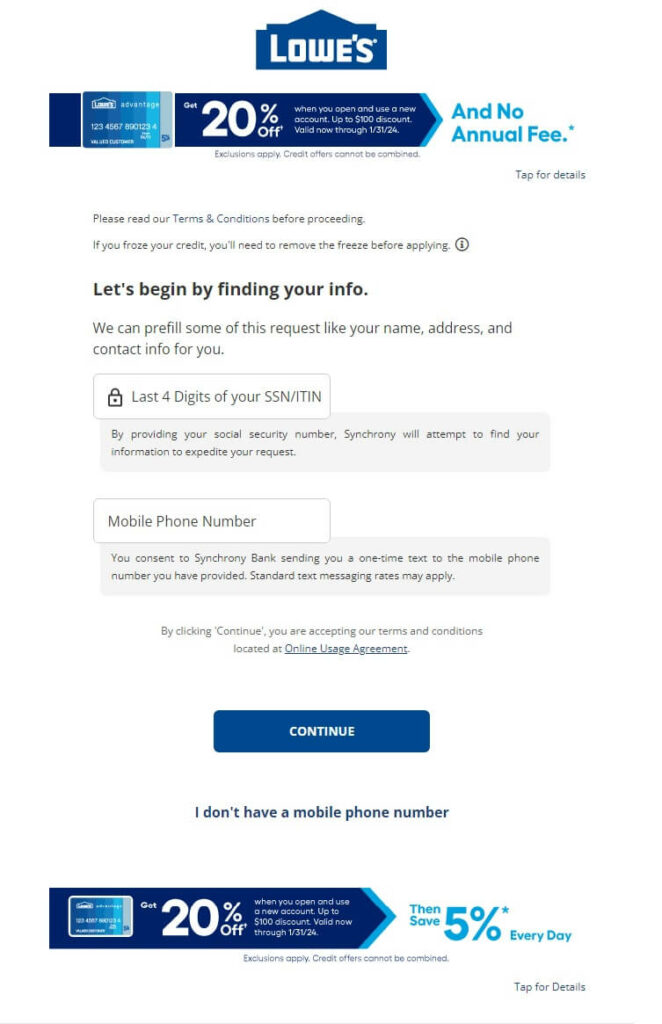

Applying for a Lowe’s credit card is a straightforward process that can be done online. Here are the steps:

- Visit Lowe’s website: Start by visiting the official Lowe’s website. Once there, navigate to the credit card section. You can typically find it under the “Credit Services” or “Credit Card” menu.

- Select an appropriate card for you: Lowe’s provides two types of credit cards – the Lowe’s Advantage Card and the Lowe’s Business Credit Card. Business credit card is for small businesses, while an advantage credit card is for personal use. You can select the card as per your requirement and tap on the Apply Now button.

- Complete the application form: You will be redirected to a safe application form where you must give personal data like your address, name, income details, and social security number. Ensure that you are providing all the information correctly so that you don’t have to face delays in the application processing.

- Review the terms and conditions: Reading and understanding all the necessary terms and conditions before submitting your application form is important. By doing so, you will clearly understand the fees, interest rates, and other related information. Take considerable time before applying and review all the details properly.

- Propose your application: After reviewing and understanding all the terms and conditions, it’s time to submit your application by clicking on submit button. You may have to wait a few moments while lowes credit card application is being processed. Sometimes you may get an immediate decision on the lowes credit card applications, while it may also take a few days for submission, which can be possible in case of a major review process.

How to Manage Lowe’s Credit Card Online?

Managing your Lowe’s credit card pay online is convenient and lets you track your purchases and payments. Here’s how you can do it:

- Create an online account: After you have been approved for a Lowes application for credit card, you will need to create an online account. To do this, go to Lowe’s website and look for the “Sign In” or “Register” option. You will typically need to provide your credit card number, name, and other relevant information.

- Log in to your account: After setting up the account, you can now log in with the help of your credentials, including username and password.

- Make payments: One of the essential features of managing your Lowe’s credit card online is the ability to make lowes credit card payment conveniently. To ensure you get all the due dates, automated payments from your bank account. Navigate to the “Payments” section and choose the lowes online payment method that suits you best.

- Keep an eye on your account activity: Keeping track of your account activity can help you identify unauthorized charges. You can quickly spot discrepancies and report them to Lowe’s customer service by reviewing your transaction history online.

- Take advantage of online offers and rewards: Lowe’s frequently offers special promotions and rewards for its credit cardholders. You can stay updated with these offers by logging into your account regularly and using the savings. This can include exclusive discounts, cashback rewards, and special financing options.

Lowes Credit Card Benefits

Lowe’s is a name that often comes to mind when it comes to home improvement projects. With its extensive range of products, affordable prices, and excellent customer service, Lowe’s has established itself as a go-to destination for all things related to home improvement and renovation. And for those frequent shoppers, having a Lowe’s Credit Card can be a rewarding experience.

One of the key Lowes credit card benefits is its exceptional rewards program. A reward program can greatly improve your shopping experience, no matter your experience level. To discover how you can make the most out of your Lowes personal credit card.

- Access to financing options: Firstly, as a lowe’s consumer credit card, you have access to exclusive financing options. Lowe’s offers special financing on purchases of $299 or more, allowing you to spread out your payments over a specified period without accruing any interest charges. This can be particularly beneficial for larger and more expensive home improvement projects, as it allows you to pay over time, easing the burden on your budget.

- Several rewards program: The Lowe’s Credit Card also offers a generous rewards program. For every dollar, you spend at Lowe’s, whether on products, services, or installation, you earn 5% back in rewards. These rewards can be redeemed as Lowe’s Gift Cards, which can be used for future purchases. With a 5% back, you’ll be able to accumulate rewards quickly, making it a fantastic incentive to continue shopping at Lowe’s.

- Personalized discounts: Lowe’s frequently sends out personalized offers and discounts to cardholders. You can choose from discounts on specific products to coupons offering percentage-off discounts, making it even easier to save and earn rewards. Being a cardholder gives you an advantage, as you can access these exclusive deals, giving you more value for your money.

- Additional perks: Besides the rewards and special offers, having a Lowe’s Credit Card includes additional perks. For instance, as a cardholder, you enjoy free shipping on qualified orders when you purchase online. It is especially convenient to shop online for people who want to buy bulky or hard-to-transport items.

- Extended warranties: Furthermore, the Lowes apply for credit provides you with the advantage of extended warranties on eligible purchases. Using your card to make a qualifying purchase can extend the manufacturer’s warranty, offering you peace of mind and saving you money on repairs or replacements.

- Easy Management of account: Lastly, using a Lowe’s Credit Card allows you to manage your account conveniently. With online account management, you can easily track your transactions, view your rewards balance, and make payments from your home. Having all your information readily available at your fingertips lets you stay on top of your spending and rewards, making it easier to plan future purchases.

Conclusion

The Lowe’s card application is a great option for frequent shoppers at Lowe’s. The lowes store credit card application process is simple and can be done entirely online. With Lowe’s credit card login apply, you can conveniently manage your credit card once approved. Paying online, monitoring account activity, and earning rewards is all possible with an online account. So, if you’re a regular shopper at Lowe’s apply for a lowes credit card online to continue exploring benefits.